March 2018

Although tax filing season has been officially open only since Jan. 29, the Internal Revenue Service (IRS) is warning that reports of refund scams are already skyrocketing. Here’s an overview of the most common type of scam and tips to avoid becoming a victim.

The Scam

Hackers steal current data from tax returns, which also might include Social Security numbers and bank account information, from infected computer hardware. Using this stolen data, the cybercrooks file fraudulent claims on behalf of the victimized taxpayer. Refund payments are made to these innocent victims – often via direct deposit to their banking accounts. At this point, the scammers might pose as IRS agents and call the unwitting victims to demand return of the refunds. Sometimes the call is a recording accusing the taxpayer of fraud and threatening arrest and other scary consequences.

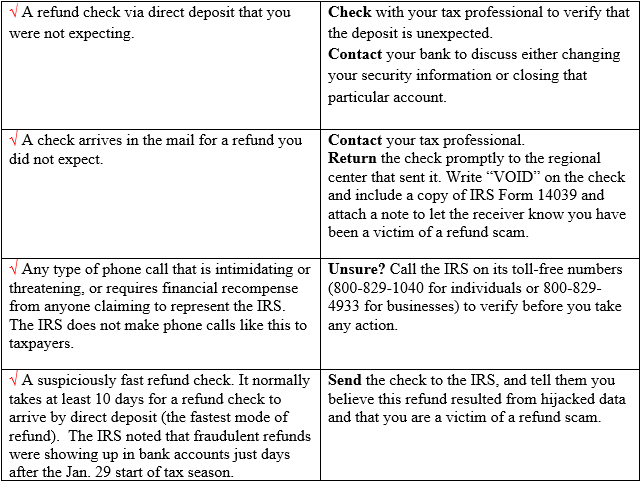

Red Flags and What To Do

Heads-Up

Although the IRS has no explanation for how the thieves were able to get into the system within hours of the start of the filing season on Jan. 29, speculation has run rife. Some have wondered if the cybercrooks had inside help. The IRS emphatically denies that the problem originated within IRS systems or data. The hacking seems to have targeted businesses specifically created to prepare and file tax returns. Additionally, some think the recent major data breach at Equifax has placed millions of people at potentially greater risk of having their personal information stolen.

The IRS expects victims of refund scams to be proactive and return refunds promptly that were issued in response to a fraudulent claim. To add insult to injury, it may take up to four months before victims are able to get the legitimate refunds that are due to them.

Forewarned is forearmed. There are some things you can do to protect yourself. First, discuss this issue with your professional tax advisor. Plan to file as promptly as you are able to do so. Scammers count on being able to get their fraudulent filing to the IRS before the legitimate tax returns arrive.